Capital Allowance is used as a subsidy to for the depreciation of fixed assets. Capital allowance is given to reduce the tax payable for the capital.

Capital allowance is only applicable for businesses and not individuals. The nature of the capital and the purpose of the capital must be for the use of a business.

QE includes:

Capital allowances consist of an initial allowance (IA) and annual allowance (AA).

IA is fixed at the rate of 20% based on the original cost of the asset at the time when the capital was obtained.

Annual allowance is a flat rate given annually according to the original cost of the asset. The annual allowance is distributed each year until the capital expenditure has been fully written off.

Annual allowance rates depend on the types of assets. The rates are as follow:

| ASSETS | IA (%) | AA (%) |

|---|---|---|

| Heavy machinery | 20 | 20 |

| General plant and machinery | 20 | 14 |

| Furniture and fixtures | 20 | 10 |

| Office equipment | 20 | 10 |

| Others Assets*** | 20 | 10 |

| Motor vehicles | 20 | 20* |

| ICT equipment and computer software packages | 20 | 20 |

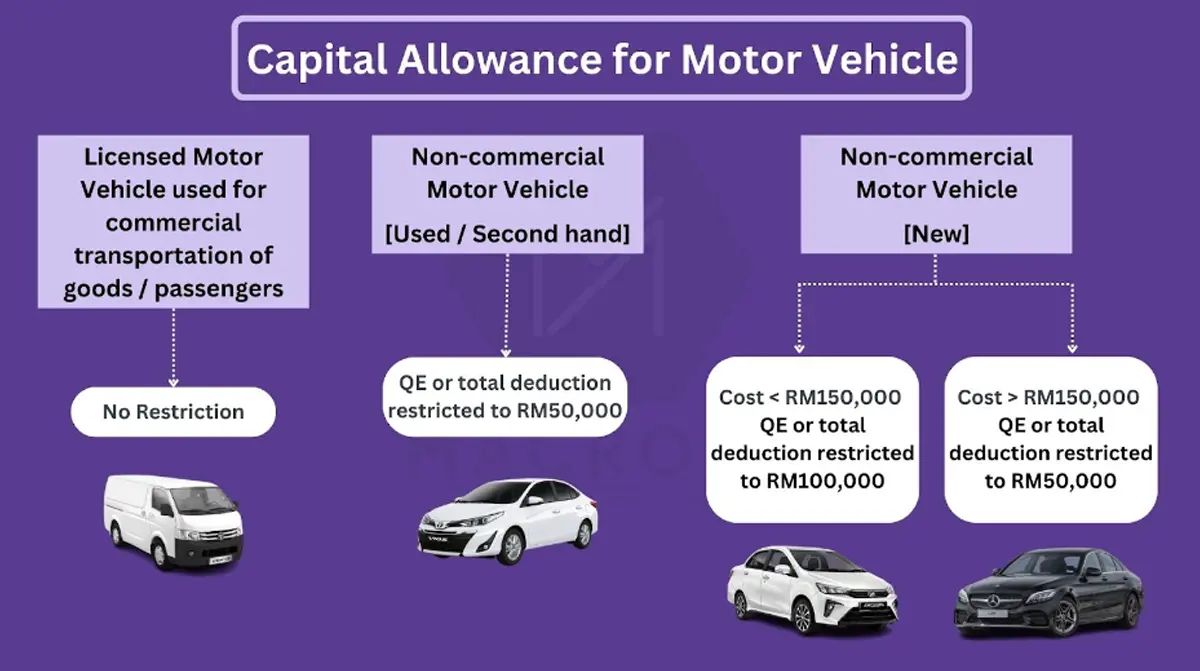

* QE for non-commercial vehicle is restricted to the maximum amount below:

| MOTOR VEHICLE | MAXIMUM QE (RM) |

|---|---|

| New vehicles purchased where the total cost is RM150,000 or less | 100,000 |

| Vehicles other than the above | 50,000 |

MACROSS helps you to build your business globally.

Our services are offered in Malaysia, Singapore, Indonesia, Philippines, Japan, China, Hong Kong and Taiwan.