New Audit Exemption Qualifying Criteria

(Effective for financial periods starting on or after 1 January 2025)

Audit Exemption (SSM Reference) - New Audit Exemption Qualifying Criteria.pdf

1. Purpose

The government has introduced an audit exemption policy to reduce the burden on small and medium-sized enterprises (SMEs). The following conditions must be met:

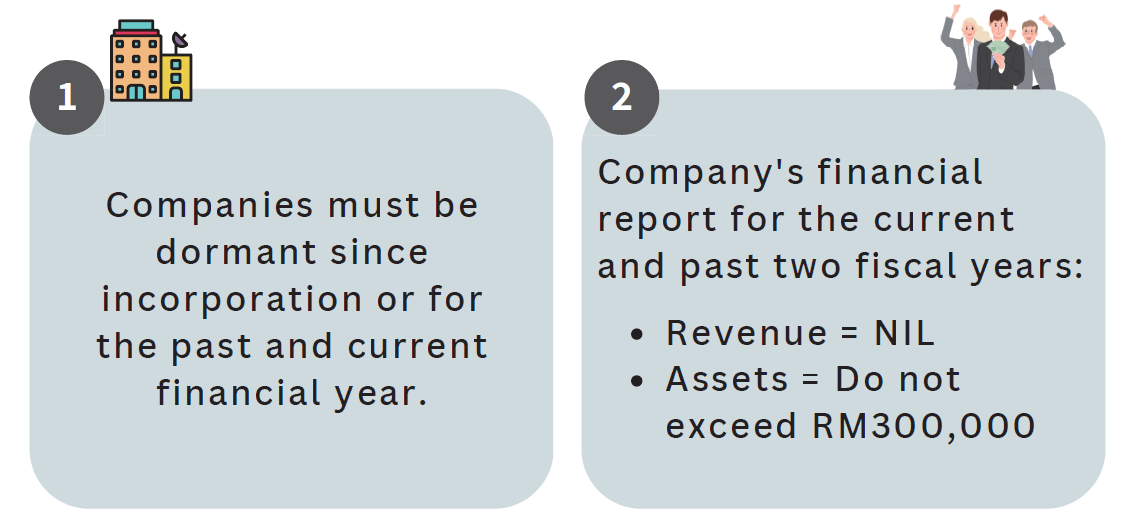

2. Current Criteria

3. New Criteria Requirement

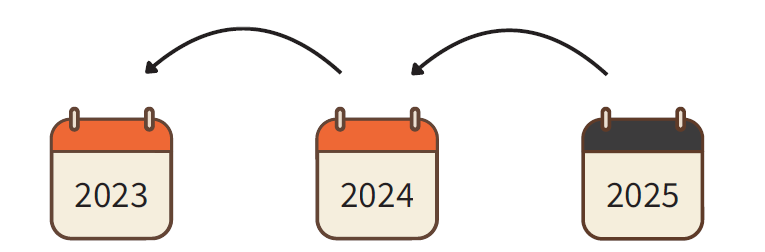

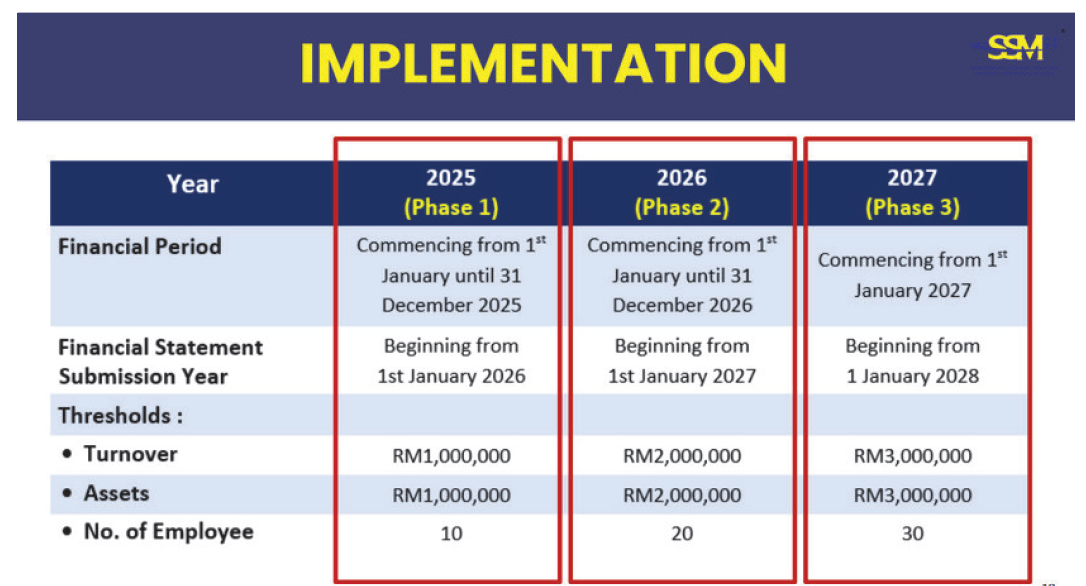

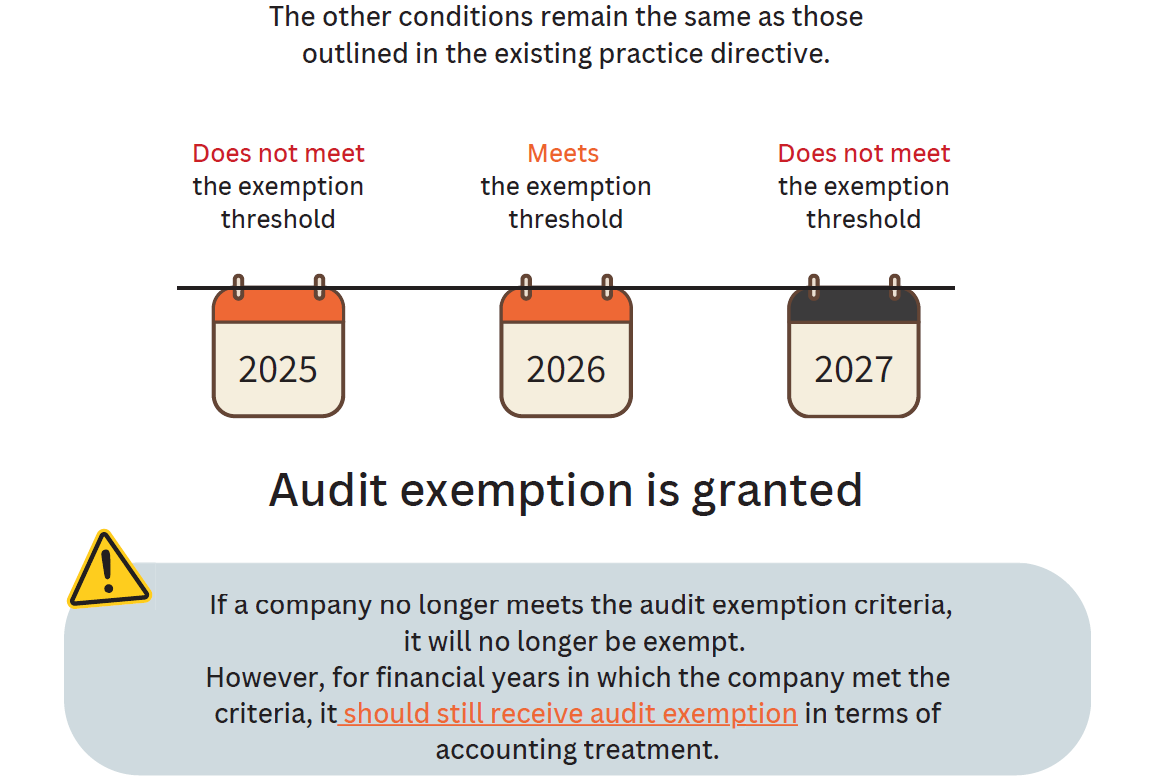

A private company qualifies for audit exemption if it meets any 2 out of 3 criteria for the current and past two financial years:

✔ Revenue: ≤ RM3,000,000

✔ Total Assets: ≤ RM3,000,000

✔ Employees: ≤ 30

4. Phased Implementation

To help companies adapt, thresholds increase gradually:

5. Additional Notes

❌ Not Eligible:

✅ Dormant companies are exempt if inactive since incorporation

6. Responsibilities of Exempted Companies

MACROSS helps you to build your business globally.

Our services are offered in Malaysia, Singapore, Indonesia, Philippines, Japan, China, Hong Kong and Taiwan.