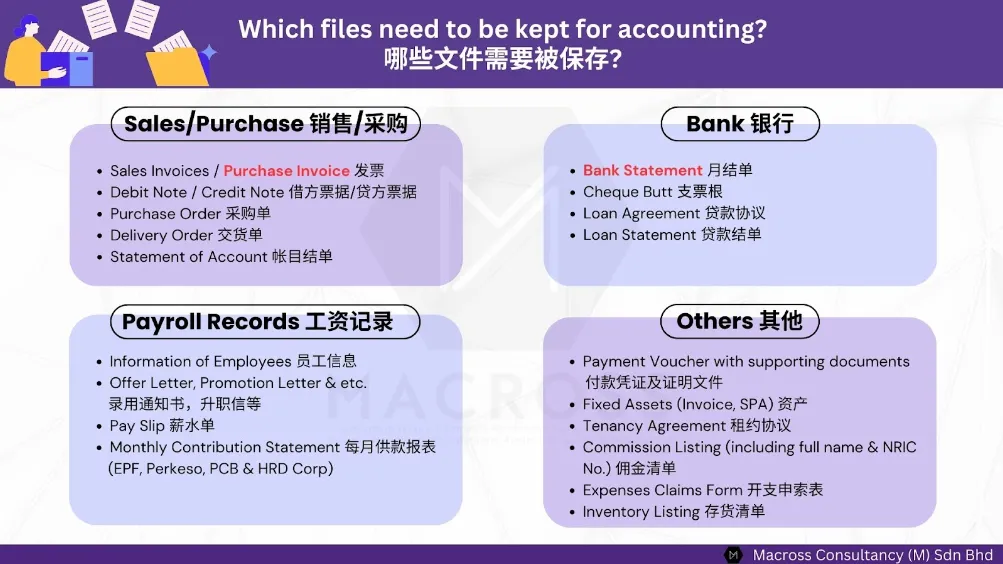

When documents are ready to pass to the accountant for updating, to ensure accurate updates to the accounts, it is advisable to maintain the following documents, whether in electronic or hard copy format:

Following Section 82A (1) of the Income Tax Act 1967, it is imperative to maintain comprehensive records and documents, ensuring their secure retention for a minimum period of seven years from the end of the assessment year.

Failed to adhere to this requirement may result in the following consequences:

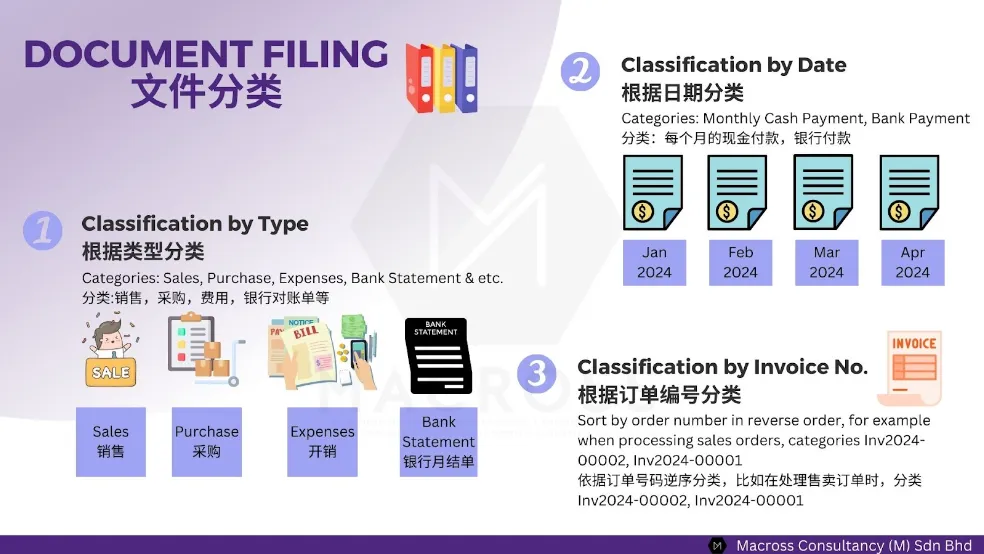

How should I do the document filing?

Document filing can be sorted into different folders according to these types:

| NAME | EXAMPLE |

|---|---|

| Profit & Loss | Also called an ‘Income Statement’, contains the company’s revenue & expenses (Revenue - Expenses = Net profit / Net loss) |

| Type of document | Sales invoice / Purchases invoice / Expenses payment/ Bank statement |

| Date of document | Cash payment / Bank payment |

| Alphabet of document | Based on supplier/customer name |

| Number of document | Sales invoice number from 2023/001~100 in one folder |

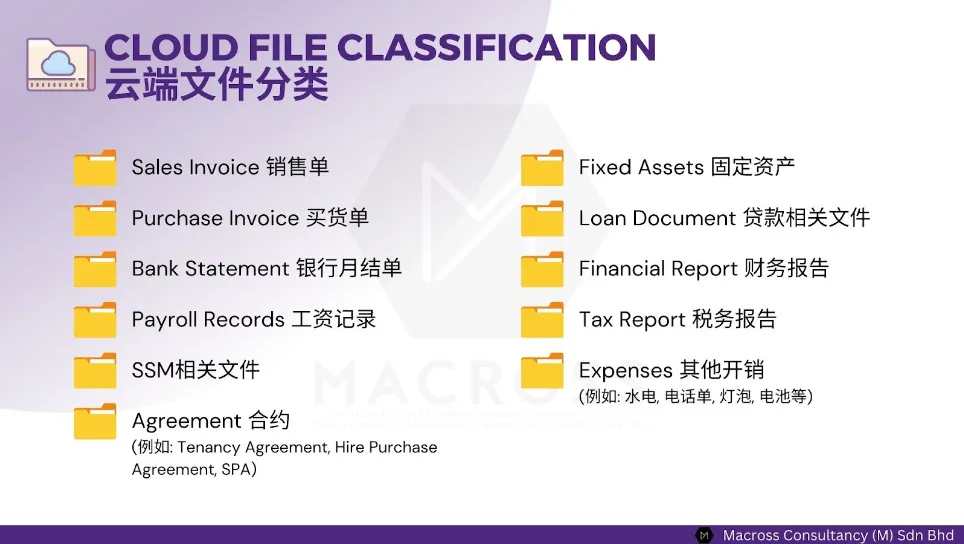

Alternatively, you may consider saving your document in a secure cloud storage solution to ensure accessibility and data preservation. The cloud file can separate the folder as follows:

Generally, overseas suppliers may only provide insufficient detail of invoices for payment arrangements such as:

These documents do not qualify as an official or valid invoice. It is advisable to request an official invoice from the supplier for proper documentation and accounting purposes.

To better record the document, we recommend sealing the document by using a record stamp, this is to:

MACROSS helps you to build your business globally.

Our services are offered in Malaysia, Singapore, Indonesia, Philippines, Japan, China, Hong Kong and Taiwan.