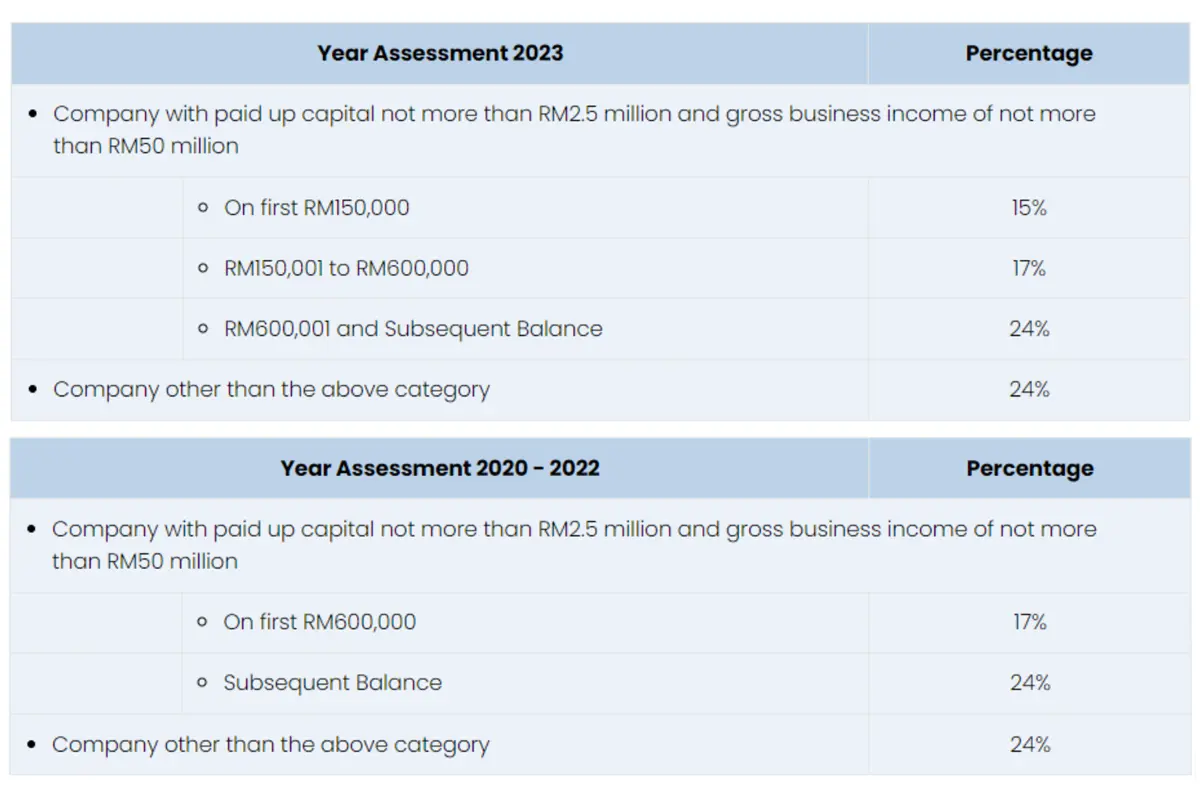

The corporate income tax rate in Malaysia is 24% for companies that have a paid-up capital of more than RM2.5 million or a gross business income of more than RM50 million.

For companies that have a paid-up capital of not more than RM2.5 million or a gross business income of not more than RM50 million, the tax rate is as follows:

For more information:

MACROSS helps you to build your business globally.

Our services are offered in Malaysia, Singapore, Indonesia, Philippines, Japan, China, Hong Kong and Taiwan.