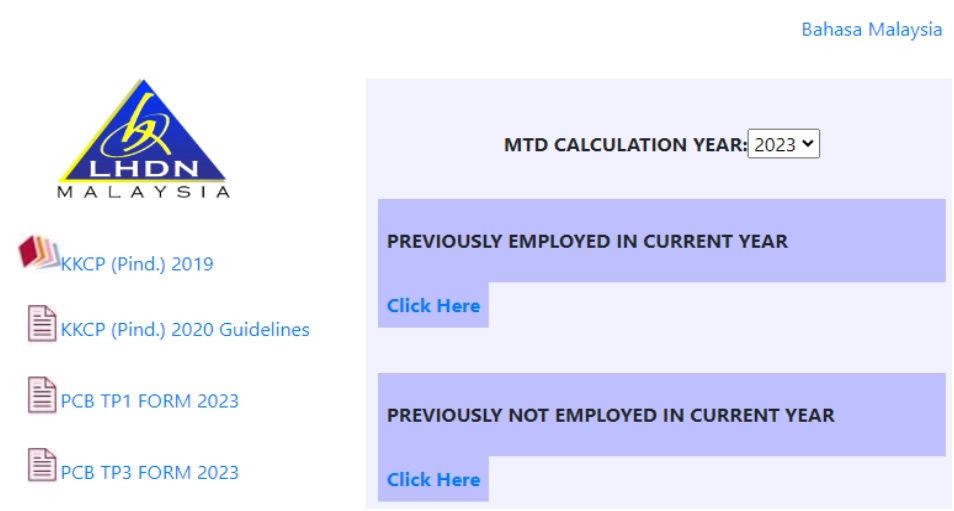

PCB/MTD is an income tax deduction mechanism from an employee’s current monthly remuneration following the schedule of Monthly Tax Deductions (PCB) or other methods approved by the Malaysian government.

PCB is designed to prevent substantial tax payments at the end of the year, and it can also exempt you from filing a tax report under certain conditions.

PCB deduction is calculated monthly, where specified amounts are directly withheld from an employee's salary. The employer retains this withheld amount and subsequently remitted to the Inland Revenue Board (LHDN) during each payroll cycle.

To facilitate the calculation and payment of PCB contributions, there are three websites available:

https://ecp39.hasil.gov.my/login

MACROSS helps you to build your business globally. Our services are offered in Malaysia, Singapore, Indonesia, Philippines, Japan, China, Hong Kong and Taiwan.

JASON老大: 为大家提供有用的资讯,从找到工作到成为老板,从资金周转到享受现金流自由,从报税到税务回扣,都为你娓娓道来。

JASON BOSS

JASON BOSS